How to make an estimated payment. Simple, secure, and can be completed from the comfort of your home.

Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding. Estimated tax is the method used to pay tax on income that is not subject to withholding.

In case your employer deducted tds from april 2025 to march 2025, form 16 must reach you no later than june 15,.

Estimated Tax Due Dates 2025 Form 2024Es 2025 Angele Valene, You can make an estimated payment online or by mail. If you are mailing a payment you must file a declaration of estimated.

When Will The Irs Finalize Forms For 2025 Ketty Merilee, Range of income ( rs.) 3. By intuit• updated 2 months ago.

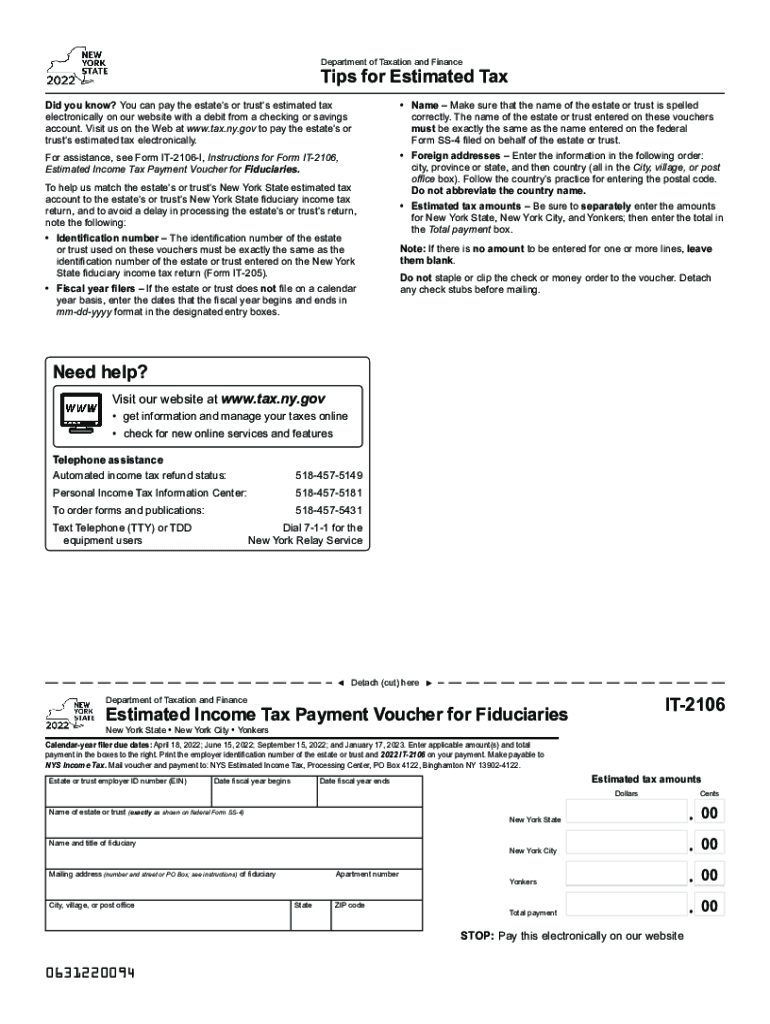

It2106 Fill out & sign online DocHub, Marginal relief may be available. The irs is reminding taxpayers who need to make estimated tax payments that the 2025 second quarter estimated tax deadline is june 17.

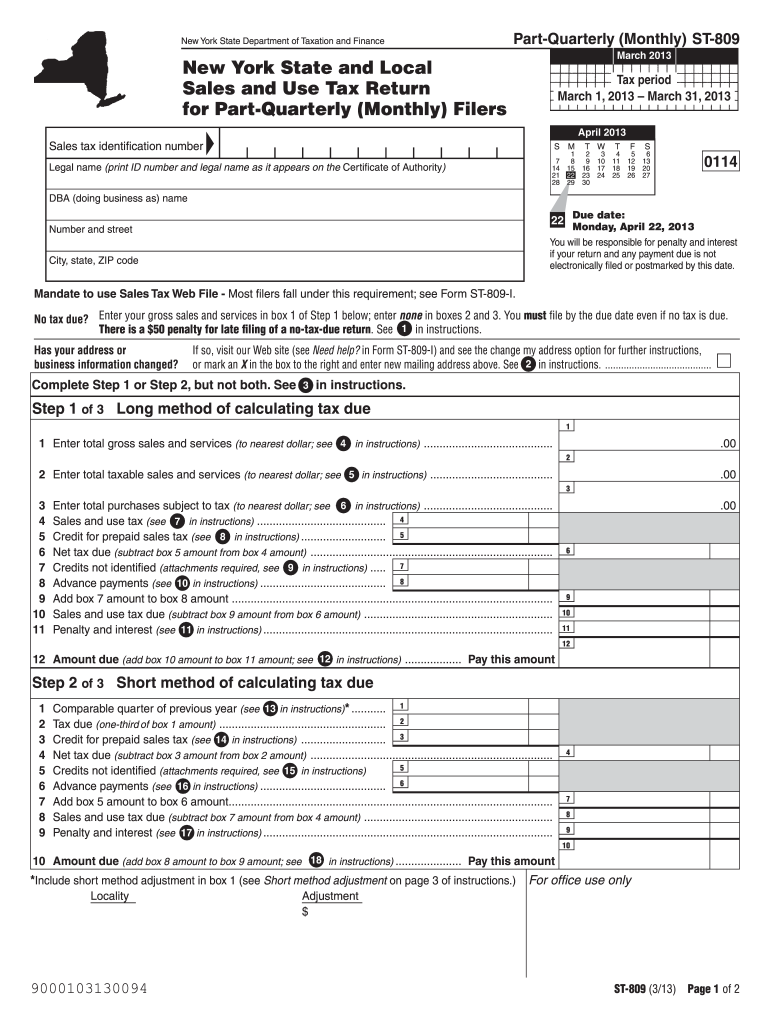

Irs form 809 Fill out & sign online DocHub, Marginal relief may be available. Form is used by individual taxpayers mailing a voluntary or mandatory estimated payment;

20222024 Form OK OW8ESSUP Fill Online, Printable, Fillable, Blank, Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding. Benefits to electronic filing include:

2025 Quarterly Tax Due Dates Aviva Caritta, Form is used by individual taxpayers mailing a voluntary or mandatory estimated payment; The deadline for issuing form 16 is set for june 15, 2025.

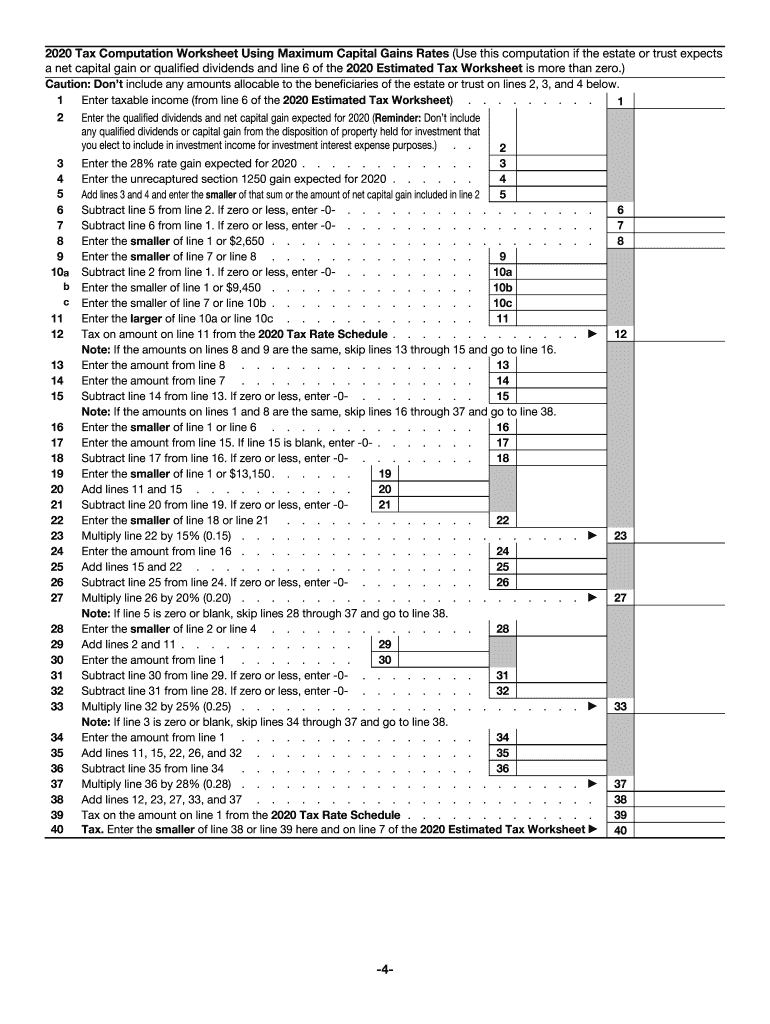

Estimated 20202024 Form Fill Out and Sign Printable PDF, Using a preprinted estimated tax voucher issued by the indiana department of revenue (dor). Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding.

Estimated Tax Forms For 2025 Perry Brigitta, How do i print estimated tax vouchers for my 2025 taxes? Marginal relief may be available.

How Do I Calculate My Estimated Taxes For 2025 Hanny Kirstin, When paying estimated taxes, you. By the end, you’ll feel more equipped to navigate estimated.

Maryland estimated tax Fill out & sign online DocHub, You should make estimated payments if your estimated ohio tax liability (total tax minus total credits) less ohio withholding is more than $500. Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding.

Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding.